Argyle Diamonds

Guide to Pricing Pink Diamonds for Investors and Private Collectors

Over the past two decades, the value of pink diamonds has significantly increased, attracting both investors and high-profile individuals who appreciate their stability and potential for substantial returns.

With a decreasing supply and growing demand, the prices of these exquisite natural gems are expected to rise further. For those looking to invest in pink diamonds, this guide provides comprehensive information, tips, and tools to make informed investment decisions in one of today’s sought-after assets.

Fundamental Principles of Pink Diamond Pricing

The fundamental pricing principle for natural diamonds, whether fancy colored or colorless, is that rarity increases value. There is no fixed linear scale for diamond pricing; each diamond is unique, and its price is determined by its distinctive features and rarity.

Pink diamonds are among the rarest and are primarily sourced from the Argyle mine in Australia, operated by Rio Tinto, the world’s largest diamond mining company. It is estimated that the Argyle mine produces at least 90% of the world’s annual supply of pink diamonds. Due to the rarity of natural pink diamonds, with only 40-50 carats found per year, the mine is expected to cease operations by 2020.

The closure of the Argyle mine is anticipated to further increase the already high prices of pink diamonds. While some may view this as a challenge and obstacle to acquiring pink diamonds (mainly investors), others may see it as an excellent opportunity to invest in a highly valuable asset.

The Rarity of Pink Diamonds?

Examining the numbers and statistics clearly demonstrates the rarity of pink diamonds, which accounts for their high price, increasing value, and the growing interest from investors and collectors at auction houses and online marketplaces.

Comparing the scarcity of pink diamonds to other diamonds in the market reveals the following: annually, 12-14 million carats of diamonds are mined, polished, and sold, with only 0.01% of these being fancy colored diamonds. Of that 0.01%, around 80% are brown or yellow diamonds, while the remaining 20% are gray or black diamonds.

Pink diamonds are estimated to make up an exceptionally small fraction of approximately 0.0001% of all diamonds sold annually. The Argyle mine, as previously mentioned, is responsible for producing 90% of the global supply of pink diamonds.

When investing in pink diamonds, targeting grades from 1PP to 6PP, 1P to 6P, or 1PR to 6PR can be a smart choice. These grades offer a balance between potential capital appreciation and affordability for both buyers and future sellers.

Although darker pink diamonds may be rarer and experience greater value growth, the pool of potential buyers for them might be smaller.

For those interested in building a portfolio of pink diamonds, it is recommended to include a broad spectrum of saturations from 1 to 6. This strategy allows for a diverse selection that can be partially sold later to either recoup the initial investment or reduce it while still retaining diamonds with appreciating value.

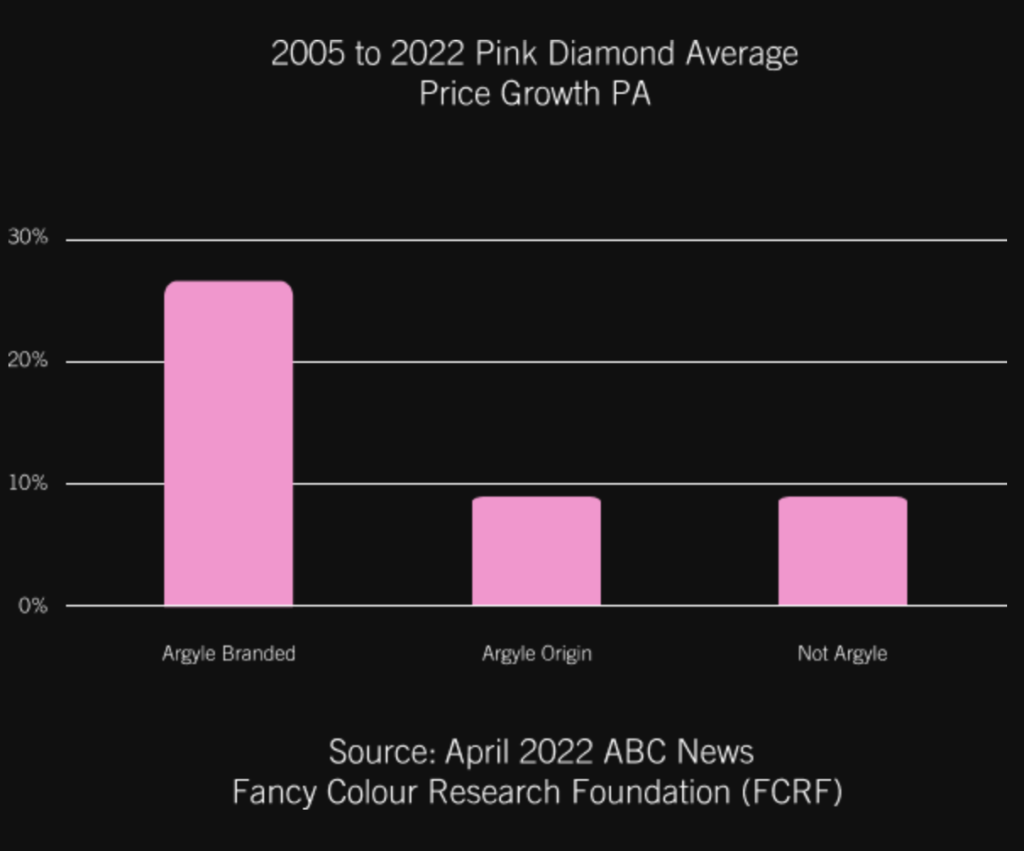

Value Growth of Pink Diamonds from the Argyle Mine Over the Past Three Decades

Recent market data shows that prices for pink diamonds from the Argyle mine have risen significantly in recent years. According to a 2022 Rio Tinto press release, Argyle-branded pink diamonds have increased in value by an average of 600% since the early 2000s.

These price increases are due to growing global demand, as buyers view pink diamonds as a secure investment with appreciating value. Over the past five years, pink diamonds have achieved a steady annual appreciation rate of 20-30%.

Reports also indicate that international demand is increasingly driven by markets such as India and China, where affluent buyers are willing to pay higher prices for these rare gems than ever before.